Liquid funds

Liquid funds are mutual fund schemes that invest their corpus in financial instruments such as Bank FD, Treasury Bills, Commercial Paper and other debt securities with maturities up to 90 days. Assets invested are not tied up for a long time as liquid funds do not have a lock-in period. Generally liquid fund are open-ended debt fund.

Who should invest in liquid funds?

Since these funds provide liquidity and not high returns, it is advised that investors looking to park their idle money should consider liquid funds as a viable option. However, one should be varied enough not to put one’s emergency corpus in liquid funds since liquid funds provide redemption in such a way that money is the credit on your account only the next day. So parking all the emergency fund in liquid funds is not a good practice. Ideally, liquid funds should be utilized to achieve your short-term objectives. Since some funds generate around 8% to 9% returns, they should definitely be preferred over savings account which provides 4% to 6% returns. In fact, the nature of their portfolio allocation is such that there is not much risk of volatility or default associated with liquid funds provided one invests in high rated (AAA or AA) liquid funds.

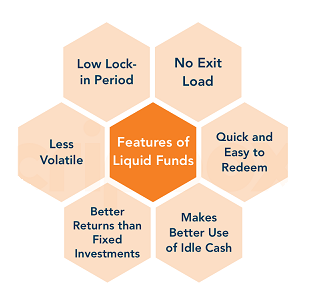

Features, Benefits and advantages of Liquid Funds. 1. Least Risk. 2. High Liquidity. 3. Quick & Instant Redemption. 4.Cut-Off Time- The cut-off time for investing in liquid funds is 2 pm. If you invest in a liquid fund before 2 pm, you will be allotted units at the Net Asset Value (NAV) of the previous day. If you invest in a liquid fund after 2 pm, you will be allotted units at the NAV of the same day. You can read more about the cut-off timings of mutual funds. 5. No exit Load. 6. Low Lock-in Period. 7. Less Volatile.

Disadvantages of liquid funds - The disadvantage liquid funds has Lowest Interest Rate Risk and investors cannot take the advantage of higher returns being offered by long-term instruments. But the biggest benefit is that though the returns are lower, the risk is nominal, making it an ideal instrument for parking short-term funds..

There are so many types of liquid funds in market like Government funds, Municipal Fixed Income Funds, Sukuk funds, Banking & PSU Debt Fund, Corporate Bond Fund, Credit Risk Fund, Gilt Fund, Liquid Fund, Money Market Fund, Short Term Fund, Ultra Short Term Fund, Treasury Advantage Fund, Multi-Sector etc.

We are tracking most of major Liquid Funds like Aditya Birla Sun Life Liquid Regular Plan Growth, ICICI Prudential Liquid Fund Growth, Reliance Liquid Fund Growth, UTI Liquid Fund Cash Plan Regular Plan Growth, Axis Liquid Institutional Growth, Kotak Liquid Fund Growth and d, Historic Returns of liquid fund, What Are Best Liquid Funds, Top performing liquid fund, Top 5 liquid fund in India, best liquid fund investments, Best performing liquid fund in 2019, best liquid fund in 2019, top liquid fund in 2019. As per your requirement & suitable for you, we suggest right Liquid Income fund to you for your regular income or short term money parking need or as per your any financial goals.

FOLLOW US!

Call Now