Income Funds

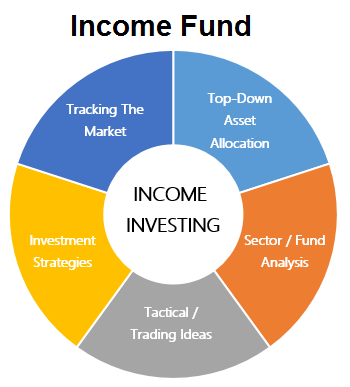

Income funds are mutual funds or ETFs whose goal is to provide an income from investments, prioritize current income in the form of interest or dividend paying investments. Income funds invest in high dividend stocks, government bonds or other fixed-income securities as well as preferred shares.

Features of Income Funds. 1. Focused on providing a regular fixed income to the fund-holder. 2. They are managed by a team of well versed fund managers who revise the portfolio regularly in order to make the fund more adaptable and healthy in response to economic changes. 3. It can also serve as a regular source of returns for retired persons in addition to their pension and investors with a low risk appetite. 4. ETFs are more profitable as they are traded in the stock market. 5.Maintain stable returns in spite of market disturbances or changes in economic situations. 6. One can avail the benefit of indexation and reduced tax amount on returns. 7. Offer high liquidity by allowing the investor to remove their funds whenever they require money. 8. One can get better returns than 4% interest in normal savings bank account and normal bank fixed deposits.

why you should not ignore investing in fixed income?

India has traditionally been a ‘fixed income country’. Generations of savers have automatically turned to savings instruments such as PPF, bank deposits, post office deposits, etc., for all their savings needs. This is something that I’ve often written about and pointed out that long-term savings and investments must be invested in equity or equity-backed mutual funds. Interestingly, it increasingly looks like that a certain proportion of younger savers have taken to the equity mantra a little too seriously. Savers who start investing in equity mutual funds and have a good experience tend to invest all their saving in equity funds. This is a mistake, as it goes against the concepts of asset allocation nd asset rebalancing.

How Does Fixed Income Mutual Fund Work? - Fixed income securities such as corporate bonds, government bonds, preferred company stocks and certificates of deposit (CDs) are more stable than pure equity holdings. Fixed income mutual funds are those mutual funds which give you returns at fixed intervals - monthly, quarterly or half yearly. Investors tend to rely on this asset class more during times of economic downturn or when steady income is the objective of the investment account.

There are so many types of fixed income mutual funds in market like Government funds, Municipal Fixed Income Funds, Sukuk funds, Banking & PSU Debt Fund, Corporate Bond Fund, Credit Risk Fund, Gilt Fund, Liquid Fund, Money Market Fund, Short Term Fund, Ultra Short Term Fund, Treasury Advantage Fund, Multi-Sector etc.

We are tracking most of major Fixed Income Funds and best fixed income investments, best fixed income mutual funds in 2019. Top best fixed income mutual funds in 2019. As per your requirement & suitable for you, we suggest right Fixed Income fund to you for your regular income or child education expences or for your retirement life, or foreign tour or as per your any financial goals.

FOLLOW US!

Call Now