What is Small Cap Mutual Funds?

Small cap mutual funds are those equity funds that focuses on small market capitalization companies which have a high potential growth in the future. Overall, Smallcap companies tend to offer aggressive growth potential than large cap. Advisors do not recommend Small cap fund to new investors. According to new Sebi guidelines, small cap mutual fund schemes must invest at least 65 per cent of their corpus in very small companies.

Your decision to invest in Small cap mutual funds must align to your risk tolerance, investment horizon and goals. Generally, if you have a long-term goal (say, 5 years or more), it is better to go for Small cap equity funds. It will also give the fund ample time to ride out the market fluctuations.

Who should Invest in Small cap mutual Fund

Many wealth advisors believe that investors could go for a staggered investment in small cap mutual funds. You need to consider your age, risk tolerance, the objective of your investment, and your investment horizon. They endeavour to provide better capital appreciation over the long-term. It is also hard to find dividends among small cap funds because smaller companies like to reinvest any profits on growing their business, unlike larger companies. As they are financially strong, they are capable of withstanding bear markets, though there’s a risk that the Small cap might underperform as compared to Small-cap or small-cap equity fund. Investors with low risk tolerance can benefit from investing in Small-cap funds.

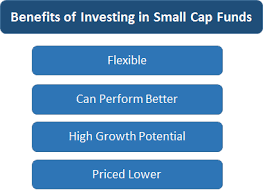

Benefits and Advantages of a Small-cap mutual fund

1. Small-cap mutual funds have more potential for earning growth. 2. Small Cap Mutual Funds help in wealth creation. 3. It is also hard to find dividends among small cap funds because smaller companies like to reinvest any profits on growing their business, unlike larger companies. 4. Small-cap equity funds can be more volatile than other diversified equity funds, but they also have the capability of earning higher returns. 5. Small-cap fund mutual investments offer agressive and high-risk returns. They are not capable of withstanding a bear market. 6. Tax Benefits like Long term capital gains (LTCG) tax, Short term capital gains (STCG) tax, Investor does not pay any tax on dividends Disadvantages of Small Cap Mutual Funds- Small-cap funds are highly risky and volatile when compared to ELSS or large-cap equity-oriented funds. Small-cap stocks suffer from liquidity constraints due to their smaller capital base i.e. the number of shares offered by the company. Investing in Small-cap equity funds can turn out to be complicated, if you are too busy to track the market movements or finding difficulty in understanding how they work, then all you need to do is contact us. You can invest in hand-picked funds in a hassle-free and paperless manner. Some times Small cap mutual funds offer cheap returns than large cap or mid cap funds.

You must know to how do Small cap mutual Fund work and there are so many types of Small cap mutual funds like ICICI Prudential Value Discovery Fund, Invesco India Growth Fund, Mirae Asset India Equity Fund, Franklin India Flexi Cap Fund, Kotak Select Focus Fund Regular Plan etc.

We are tracking most of major Small cap Equity Funds and stock funds, Best Mutual Funds 2019, top performing Small cap mutual funds, Top performing Small cap mutual Fund, Top 5 Small cap mutual Fund in India, best Small cap mutual Fund investments, Best performing Small cap mutual Fund in 2019, best Small cap mutual Fund in 2019, top Small-cap equity mutual funds in 2019, Top ranked funds to their historic returns, Top mutual funds schemes to invest. As per your requirement & suitable for you, we suggest right Equity fund plan to you for your child's higher education or marriage, or foreign tour or as per your any financial goals.

FOLLOW US!

Call Now