IPO-Initial Public Offering

Companies can raise equity capital with the help of an IPO. An IPO refers Initial public offering means company sold their shares to institutional investors and retail investors in a new stock issuance for raise capital. The company which offers its shares, known as an 'issuer'. An IPO is underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges.

If you want to purchase shares in the IPO or afterward open market, register with a stockbroker and wire funds to your brokerage account. When the IPO occurs, you can apply for shares by call your broker or go online subscriptions. After IOP those shares listed in various stock exchanges and can be further sold by investors through secondary market trading.

Companies have several options for raising capital, but a popular route is issuing stock to the public.

Features and Benefits of IPO

An IPO consists some benefits and features like Access to Risk Capital, Most companies will find it difficult to raise equity from venture capitalists and other big investors, Increased Public Image, Stock Options, Facilitates Mergers and Acquisitions, Liquidation, Responsibilities, Sharing Corporate Control, Sharing Financial Gain

An IPO comprehensively consists of two parts. The first is the pre-marketing phase of the offering, while the second is the initial public offering itself.

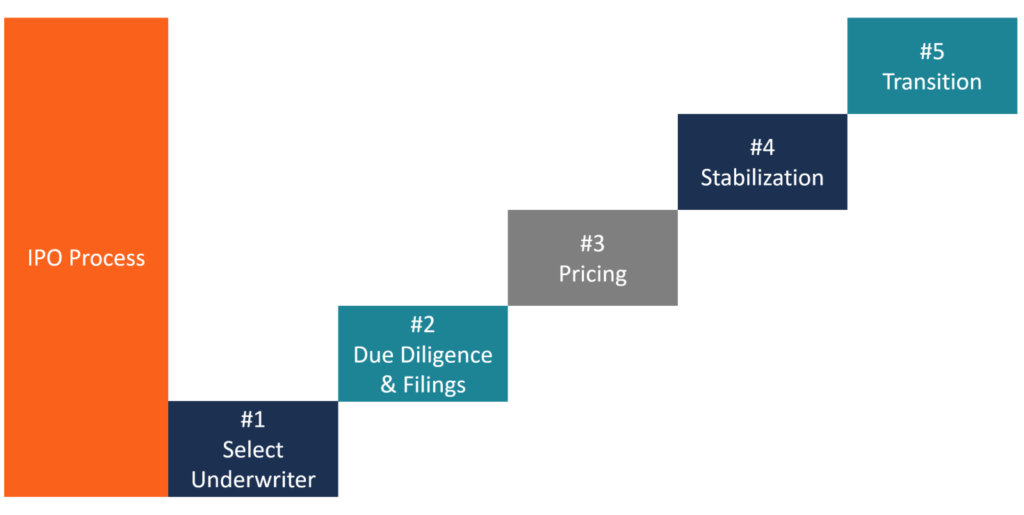

9 important steps in the IPO process

1. Write your company's story

2. Draft the Red Herring document

3. Due diligence and filings

4. Be ready with your financial reporting systems

5. Choose your investment bankers

6. Decide price of your IPO

7. Register with SEBI

8. Start your advertisement and road show

9. Now, get ready listing IOP on stock exchanges

Disadvantages of IPO

1. IPO Process is costly.

2. Control of the business goes to the Board of Directors.

3. Company is now under constant scrutiny by the SEBI.

4. Original owners may not be able to sell their shares of stock immediately, as doing so could reduce the stock price.

There are lost of procedure IPO and SEBI rules and regulations. We suggest and guide how to raise fund via IPO & choosing Investment Bankers, Registrant & deciding IPO pricing.

FOLLOW US!

Call Now