Accidental Insurance

Accident insurance is a type of General Insurance that pays out a lump sum if you incur specific kinds of injury as a result of an accident. It covers

Dislocation, Laceration, Concussion, Fracture, Eye injury, Burn, Dental damage, Accidental death and dismemberment.

Two wheeler Insurance, Car Insurance, Travel Insurance, Home Insurance is also type of General Insurace.

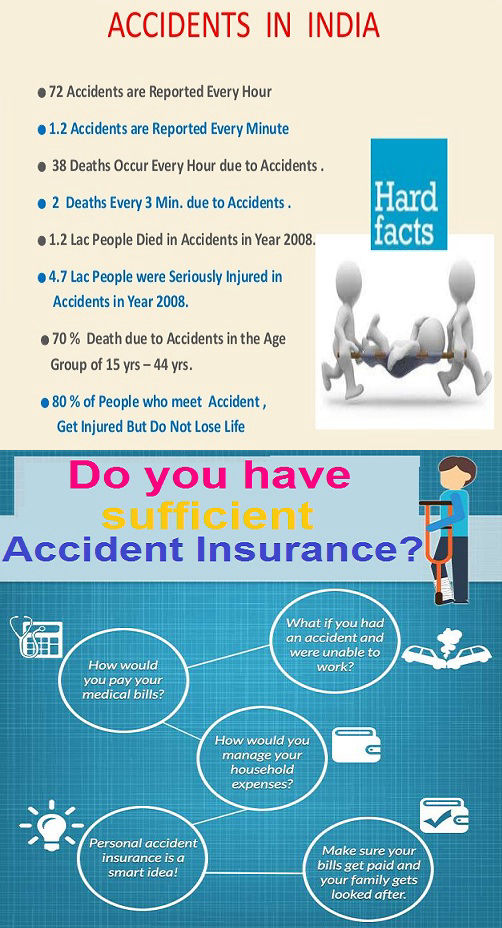

Why should accidental insurance necessary ?

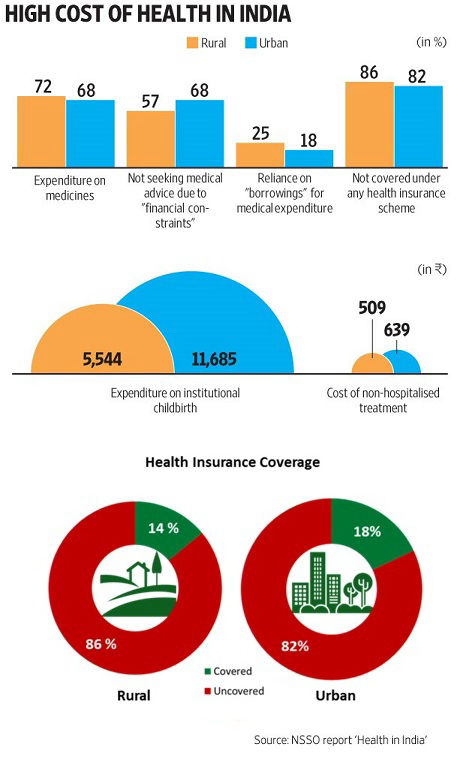

In a country like India, where the population is on a constant boom, the number of vehicles plying on the road is also facing an alarming increase which has led to a lot of traffic and has become the prime reason for alarming rise in the number of accidents. You should buy a personal accident policy because it plugs an important hole in your insurance portfolio. Personal accident insurance is a policy that can reimburse your medical costs, provide compensation in case of disability or death caused by accidents. A personal accident plan also compensates for loss of income due to accident, permanent complete disability or permanent partial disability. Further, an accidental cover needs to be supplemented with term cover, so that one covers life risk, when death occurs due to causes other than an accident. If one does not have sufficient term insurance, then you should need to increase the amount of accidental cover.

Every accident may not lead to death. Some may end up in permanent or partial disability. The figures indicate that the cases of death due to accident in 2010 were lesser (1.3 lakh cases) than cases of serious injuries and amputation of limb (over 5 lakh).

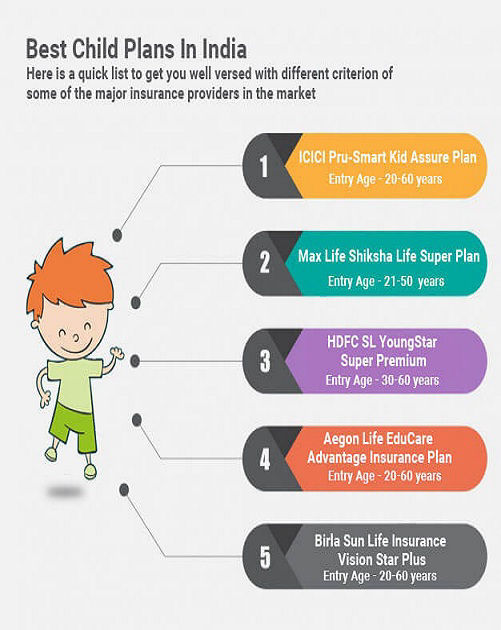

There are so many accidental insurances in market. like HDFC Ergo General Insurance, Bharti AXA Smart Individual Personal Accident, Apollo Munich Individual Personal Accident Standard, ICICI Lombard Personal Protect, United India Personal Accident Insurance, Oriental Janata Personal Accident Policy, Star Health Accident Care Individual Insurance, National Insurance Individual Personal Accident Policy, Bajaj Allianz Premium Personal Guard Plan, Religare Secure Personal Accident Insurance, Reliance Personal Accident Policy, New India Personal Accident Policy etc.

We are tracking most of major Accidental insurance plan. After considering all aspect of you like as per your requirement, your age, your responsibilities, type of plan, after your financial risk calculations, policy premium, Policy Coverage terms, Benefits, Add-on terms, Process of a claim, Waiting period on pre-existing disease exclusions, & suitable for you, we suggest right personal accident plan to you for your secured future life.

Charges - We advice right Accidental Insurance Plan at Rs. 1000 only, Video calling advisory is also available in this.

FOLLOW US!